Understanding Travel Insurance and Medevac Coverage

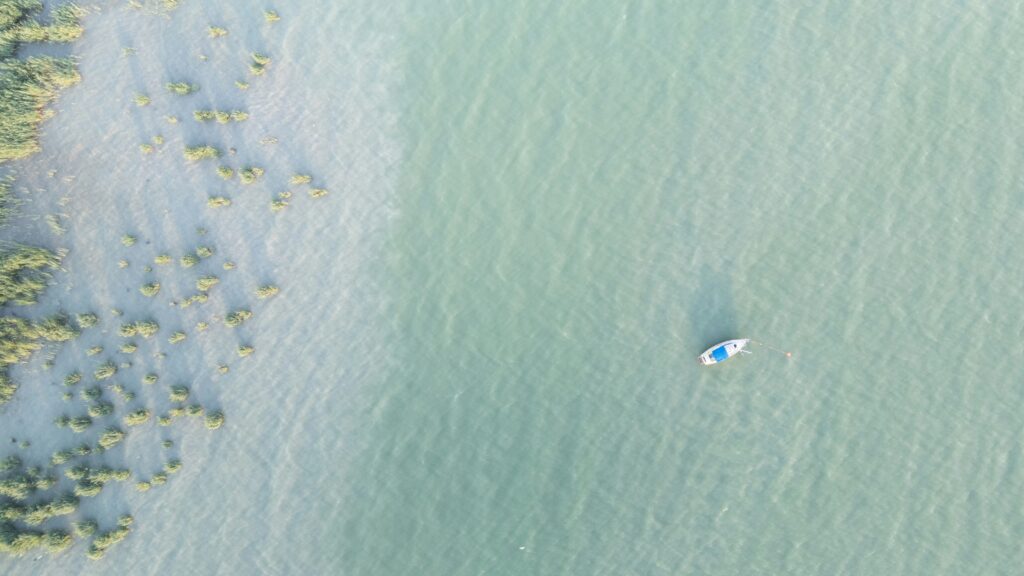

When planning a trip, whether it’s a beach getaway in the Turks and Caicos Islands (TCI) or a trek through the mountains, ensuring your safety is key. One of the most critical aspects that often gets overlooked? Travel insurance, particularly when it comes to medical evacuations (medevac). The last thing you want is to find yourself in a medical emergency away from home without adequate coverage. So, let’s delve into which travel insurance plans cover medevac from TCI—and how you can best protect yourself while enjoying your adventure.

What is Medevac Insurance and Why Should You Care?

Medevac insurance is a type of coverage that specifically pays for your transport in the event of a medical emergency. Think of it as your lifeline. Imagine you’re in the stunning TCI, lounging on the sandy beaches, when something goes wrong—maybe you twist an ankle while hiking or, heaven forbid, you suffer a more severe medical issue. Medevac is crucial because it ensures that, should you need to return home for treatment, the costs don’t come out of your pocket.

Realistically, many standard health insurance plans don’t cover international emergencies. That’s where travel insurance comes into play. Having the right plan not only gives you peace of mind but can also save you a mountain of stress while traveling.

What to Look for in a Plan

Not all travel insurance plans are created equal, especially regarding medevac coverage. Here are some essential factors to consider when shopping around:

- Medevac Coverage Amount: How much will the plan cover? Some plans might only cover a few thousand dollars, while others offer substantial limits. Make sure the coverage aligns with your travel destination.

- Geographical Coverage: Check that the insurance covers TCI. Some plans have restrictions based on where you travel.

- Pre-existing Conditions: If you have any health issues, ensure the plan covers those conditions in case of an emergency.

Best Travel Insurance Plans for Medevac from TCI

Choosing a plan that balances cost and coverage can feel like finding a needle in a haystack. Here’s a rundown of some options that are worthy of consideration:

World Nomads

If you’re a backpacker or an adventure seeker, World Nomads offers flexible plans that are perfect for those who plan on exploring off the beaten path. They provide excellent medevac coverage, including helicopter transfers if necessary.

Allianz Travel

Allianz is a reliable choice that offers comprehensive plans with generous medevac coverage. With different tiers of policies, you can choose one that fits your specific needs, whether you’re a casual traveler or a thrill-seeker.

Travel Guard

Travel Guard features benefits catered to families and solo travelers alike. They provide coverage for evacuation due to sickness or injury, plus additional services like 24/7 support—handy if things take a turn.

Real-Life Examples and Personal Stories

To put things into perspective, let’s take a look at a few real-life scenarios to illustrate the importance of having proper medevac coverage.

Imagine Sarah, who went on a diving trip in TCI. A sudden coral reef accident left her needing immediate medical attention. Fortunately, she had travel insurance that included medevac. She was flown to a hospital in the U.S. for treatment without having to stress about costs. On the other hand, Jake didn’t think he needed insurance and ended up with hefty bills after slipping while touring. Learning from his lesson, he now insists on travel insurance!

These stories highlight a valuable lesson: You can’t predict when an emergency will happen, but you can prepare for it.

Tips for Choosing the Right Plan

Choosing travel insurance doesn’t need to be overwhelming. Here are some tips to help simplify the process:

- Do Your Homework: Compare multiple plans and read reviews. Websites like InsureMyTrip or Squaremouth aggregate options, allowing you to compare coverage benefits easily.

- Consult a Real Person: Sometimes talking to an insurance agent can shed light on details that you might miss while reading the fine print.

- Double-Check your Health Plan: Make sure you know what your current health insurance covers abroad. If it does cover emergencies, you might be able to save some money on your travel policy.

Final Thoughts: Peace of Mind Is Worth It

Traveling should be about making memories, discovering new places, and enjoying life’s beautiful moments. The last thing you want to stress over is whether you’ll be covered in case of an emergency. Medevac insurance might seem like an additional expense at first glance, but consider it a necessary investment in your safety.

As you embark on your next adventure, ensure you have a plan in place that covers what you need, especially medevac. And remember, checking out other traveler experiences—like those on TravelInsuranceReview.com—can provide useful insights into making a sound choice. Wishing you safe travels and unforgettable adventures ahead!

**Related Reading:** – [Related: How to Plan a Solo Trip on a Budget] – [Related: Top Destinations for First-Time Solo Travelers] **#SoloTravel #Travel #Insurance #Plans #Cover #Medevac #TCI #Guide #Safety**